Financial Wellness Through AI and Smart Investments

What Are Mutual Funds?

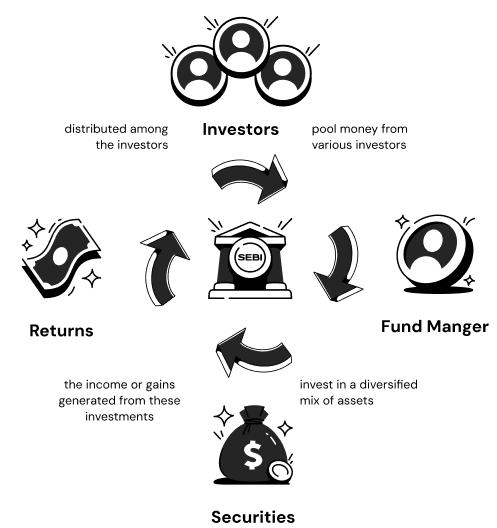

Mutual funds pool money from various investors to invest in a diversified mix of assets like equities, bonds, and money market instruments. Managed by professional fund managers, the income or gains generated from these investments are distributed among the investors based on the scheme’s Net Asset Value (NAV).

How Does It Work?

Imagine you and your friends contribute ₹10 each to buy a box of chocolates worth ₹40. You each receive 3 chocolates (or units), proportional to your investment. Similarly, when you invest in mutual funds, you own units, and your returns depend on the NAV, which fluctuates based on market performance.

Why Invest in Mutual Funds?

Mutual funds are ideal for those who want to grow their wealth but lack time or expertise to manage investments. Professional fund managers invest your money according to the fund’s objectives, while regulatory bodies like SEBI ensure transparent, fair practices.

What Are Mutual Funds?

Dhantree offers Direct and Regular Plans for investments, so you can choose the best fit for your goals.

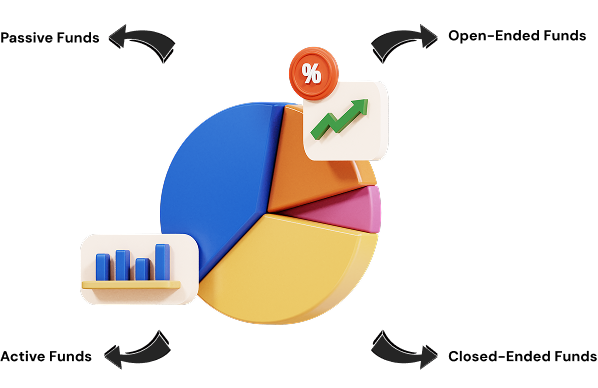

- Open-Ended Funds: Invest and redeem at any time.

- Closed-Ended Funds: Fixed investment period, with units traded on exchanges.

- Active Funds: Managed by professionals to outperform market benchmarks.

- Passive Funds: Track market indices, with lower fees. Track market indices, with lower fees.

Dhantree makes investing in mutual funds simple, flexible

Invest in Direct & Regular Plans

Choose from both direct plans (for lower costs) and regular plans (for advisor support).

Switch Between Funds

Choose from both direct plans (for lower costs) and regulaEasily switch between different mutual fund schemes to adapt to changing market conditions or goals.r plans (for advisor support).

Redeem Your Investments

Redeem your mutual fund units with just a few clicks, anytime you need liquidity

Track Your Portfolio

Get real-time updates on the performance of your mutual fund investments.

Goal-Based Investment

Set and track your financial goals (retirement, education, buying a home, etc.) with personalized mutual fund strategies.

AI-Powered Recommendations

Receive smart investment suggestions based on your risk profile and financial objectives.

Debt Mutual Fund on Dhantree

Debt Mutual Funds offer a balanced approach to investing by focusing on fixed-income securities, helping you earn stable returns with lower risk. With Dhantree, investing in debt mutual funds becomes smarter and easier.

- Stable Returns with Lower Risk: Invest in government securities, corporate bonds, treasury bills, and money market instruments — ideal for conservative investors.

- Better Than Fixed Deposits: Potential to earn higher returns than traditional FDs, especially in a falling interest rate environment.

- Liquidity Advantage: Unlike FDs, you can redeem your investment at any time without a heavy penalty, giving you financial flexibility.

- Diversification & Safety: Spread your money across various high-quality debt instruments to minimize risk and ensure capital preservation.

- Track & Manage Easily: Use Dhantree’s intuitive platform to monitor performance, duration, credit risk, and interest rate sensitivity of your debt mutual fund investments.

Gold Mutual Fund on Dhantree

Gold Mutual Funds offer a smart and convenient way to invest in gold digitally, without worrying about storage or safety. Dhantree makes it seamless for you to gain exposure to the precious metal.

- Digital Gold Investing: Invest in gold mutual funds that reflect the price movement of physical gold, without owning the metal.

- Secure & Hassle-Free: No risk of theft or storage issues. Your gold investment is handled by fund houses and regulated by SEBI.

- Hedge Against Inflation: Gold often performs well when inflation is high or markets are volatile, making it a valuable part of a diversified portfolio.

- SIP Friendly: Start with small amounts through SIPs and accumulate gold gradually over time — perfect for long-term goals like weddings or legacy planning.

- Track Gold Prices & Fund NAV: Use Dhantree’s dashboard to monitor fund performance, gold price trends, and market outlook.

Tax Saving Mutual Fund (ELSS) on Dhantree

ELSS (Equity Linked Saving Scheme) is a dual-benefit investment — offering both tax savings and equity market growth. With Dhantree, saving tax is just the beginning.

- Save Tax Under Section 80C: Invest up to ₹1.5 lakh annually and reduce your taxable income while building wealth.

- Shortest Lock-in Among Tax Saving Options: Just 3 years of lock-in, compared to 5 years for FDs or 15 for PPF.

- Equity Growth Potential: ELSS funds invest predominantly in equities, giving you exposure to market-linked returns.

- Start Small, Go Long: Begin with SIPs as low as ₹500 and build a disciplined tax-saving strategy with growth in mind.

- Goal-Based Tracking: Dhantree helps you align your ELSS investments with life goals — from buying a house to planning retirement.

International Exposure Mutual Fund on Dhantree

Investing beyond borders gives you access to the world’s leading companies and economies. International Mutual Funds on Dhantree open global growth opportunities for Indian investors.

- Global Diversification: Gain exposure to US tech giants, European innovators, and emerging market leaders — all in one portfolio.

- Currency Advantage: Risk Spreading: Diversify away from domestic market volatility by allocating part of your portfolio globally.

- Risk Spreading: Diversify away from domestic market volatility by allocating part of your portfolio globally.

- Regulated and Transparent: These funds are managed by SEBI-registered AMCs, with regular disclosures and performance updates.

- One-Click Access: Dhantree enables you to invest in top-performing international funds with ease, all through a single dashboard.